Tools to Help Manage Your Finances

The My Savings Goals and My Budgets features are free personal financial management tools within Internet Banking and Mobile Banking that complement your day-to-day account management and help give you a more complete view of how you are saving and spending your money.

My Savings Goals

The My Savings Goals feature provides a means to hold yourself accountable to any savings milestones you'd like to achieve – whether saving for a specific purchase, building an emergency savings cushion, or stashing away cash for anything else you want to save for.

My Budgets

The My Budgets feature offers budgeting tools that categorize your income and spending behavior so that you get a better picture of how your are managing your finances.

The My Savings Goals feature must be set up and maintained within Internet Banking, but can be viewed within Mobile Banking. The My Budgets feature can be set up and maintained within Internet Banking or Mobile Banking.

My Savings Goals

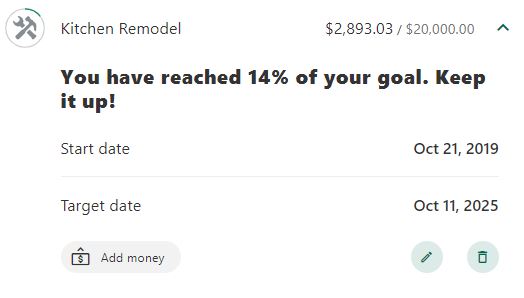

You can create a savings goal, perhaps for a new car, by attaching a goal amount and target date to a savings account where you are the primary owner. You can create more than one goal for an account.

In addition to regular transfers, you can transfer funds right within your goals through the Add Money button. You can also reallocate funds from other goals tied to the same account. Keep in mind that My Savings Goals transfers from tiered money market accounts count towards your Regulation D limit, just as like other Internet Banking or Mobile Banking transfers.

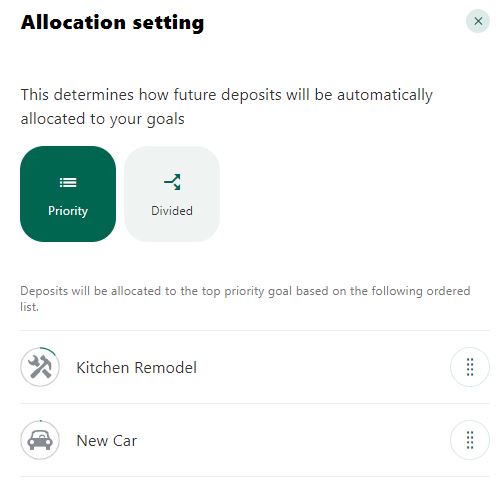

Click the Allocation settings button

- Select Priority to allocate deposits based on the order in which the goals appear within your group. Spending goals at the top of the list receive the full amount of your deposits until your goal is met. Withdrawals remove funds from the lowest ranked goal. The goal at the top is ranked the highest and the goal at the bottom is ranked the lowest. You can change the ranking of a goal by dragging each goal to a different position.

- Select Divided to allocate deposits across all goals in a group tied to a particular account. Deposits are distributed based on the amount required to complete a goal compared to the total needed to complete all goals in the group.

My Budgets

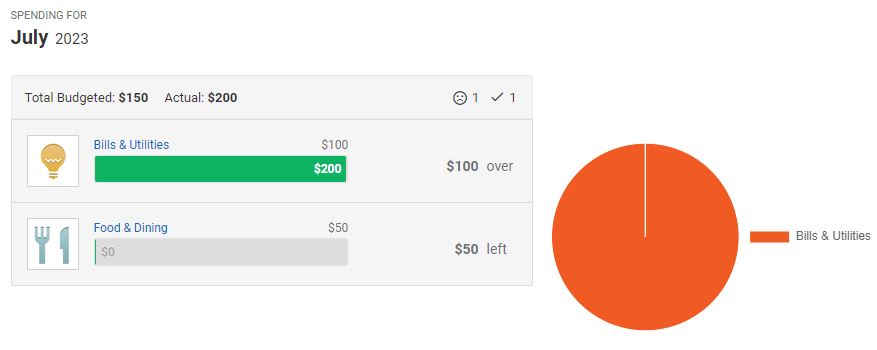

When setting up a budget, you assign accounts, income, and expenses related to your budget goals. From there, categorize applicable account transactions as they relate to your budget. As you categorize more transactions over time, you'll see if you are staying within your budget or going over it.

- The Spending tab provides a detailed look at your spending habits compared to your budget over the selected time period.

- The Income tab provides a detailed look at your actual income compared to your expected income over a period of time.

- You can categorize your spending on the Transactions tab. Pick from categories like Bills & Utilities, Entertainment, Food & Dining, Gifts & Donations, Health & Fitness, Home, Pets, and more. Click the transaction details to split a transaction into multiple categories.

- If the predefined categories for income and expenses don't meet your needs, customize your experience and add your own categories on the Settings tab.

Useful Resources

Your credit reports can help you understand how paying off or assuming debt influences your FICO® Score, and what you can do to maintain a solid rating.

We Are Here To Help

Important Legal Disclosures & Information

The tools and calculators on the HVCU website are provided for educational and illustrative purposes only. The accuracy of the calculations and their applicability to your financial circumstances are not guaranteed. HVCU does not provide tax, legal, accounting, financial, investment or other professional advice. The tools and calculators should not be used as a substitute for tax, legal, accounting, financial, investment or other professional advice. Your use of the tools or calculators does not assure the availability of, or your eligibility for, any specific product offered by HVCU or its affiliates. The terms and conditions of specific products may differ and affect the results obtained by using these tools and calculators. All financing is subject to credit approval. The default figures, amounts and information shown in the tools and calculators are hypothetical and may not be applicable to you. Please consult with qualified professionals to discuss your particular situation.